AROC INSURANCE

- CAR INSURANCE

- BREAKDOWN COVER

- HOME INSURANCE

- TRAVEL INSURANCE

SAVE £53 on your car insurance

with AROC Insurance

Stats show that for 2009 AROC members saved an average of just over £53 by switching to AROC Insurance - well worth the phone call then!

Savings for you

Ask us for a car quote when your renewal falls due and you too could benefit from a £53 saving off the best quote you can find. Simply call us and tell us your best quote and we’ll beat it by as much as we can. You already know that £53 is the proven average saving and many members have saved more – up to £130!

Simply have your best quote to hand and then call us FREE on 0800 008 6687 for your no-obligation quotation.

The car doesn’t even need to be an Alfa for you to take advantage of the scheme. Even your friends and family could save with AROC Insurance.

Benefits for you

Though the price has to be right, it’s not all about the money. What good is a saving if you have to skimp on the cover or take a reduction in service and advice?

At AROC Insurance we promise that, in addition to any savings, you’ll benefit from all the advice, service and support you need.

- Personal service – your needs put above all other considerations

- No call centres – you speak to a real insurance expert in the UK

- All the ongoing support you need – by phone or email throughout the life of your policy

- Money off 2nd and subsequent cars

- Discounted home insurance for AROC Car Insurance clients

- Low cost Breakdown Cover including assistance at home

When it comes to claims, you’re not on your own either. We’re here to act on your behalf, providing a full accident management service. And, if there’s any dispute, we can call on model-specific experts within the Club to ensure you receive a fair settlement. We’re confident you won’t find that offered anywhere else!

Call us FREE on 0800 008 6687 for your free, no-obligation quotation.

Benefit to the club

Did you know that AROC Insurance returns a significant share of its earnings from your policy to the club? This works to keep your membership fee low and contributes towards a number of the other club benefits you enjoy.

So, if AROC Insurance does save you a few pounds and you benefit from a fuller service than many other companies can give, isn’t it worth the effort of switching so that you and the club can seize the benefit? We think so!

Does your current Insurer give a share to the club? We suspect not!

It’s so easy

Obtaining a quote couldn’t be easier. Simply have all your quotes to hand, call AROC Insurance FREE on 0800 008 6687 and we guarantee to beat your best quote by as much as we can.

Remember, you could save £53 over the best quote you can find and benefit from a complete and personal insurance service, all afforded by your membership to Alfa Romeo Owners Club.

Call AROC Insurance FREE on

0800 008 6687

to find out how much you could SAVE

Average member saving whole of 2009 = £53.31 where accurate ‘best quote’ information was supplied (Source: Management Information Jan 2010). Specific quotation dependant on individual circumstances. Normal underwriting criteria apply.

AROC Insurance is administered by Chris Knott Insurance who is authorised and regulated by the Financial Services Authority

High-quality, reliable breakdown cover

at a fraction of the cost.

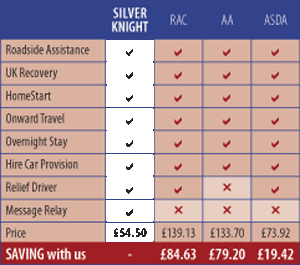

Correct as at 11th November 2009. Prices based on annual payment only, comparing AROC Insurance’s price against the nearest equivalent cover with the competition. Prices include competitors’ online or seasonal discounts where offered and relate to vehicle cover not personal cover. Premiums include insurance premium tax.

SilverKNIGHT RESCUE from AROC Insurance offers high-quality, reliable cover where you can SAVE OVER £79 compared to the AA & RAC. We offer 2 levels of cover depending on whether you require European cover or not.

UK Breakdown Cover

If it’s UK cover you need, SilverKNIGHT RESCUE PLUS is the cover level for you. Features include:

- HomeStart - to help you begin your journey when your car won’t start

- UK Roadside Assistance - to get you back on the road

- UK Recovery - to take you and your car back home again

- Onward Travel - to take you and your car to your original destination

- Overnight Stay - to help you continue your journey the following day

- 24hr Hire Car - to give you a replacement car while yours is repaired

- Relief Driver - to get you home if the driver is taken ill

- Message Relay - to let loved ones or colleagues know you’ll be late

All this for just £54.50 - that’s less than 15p a day for full UK cover and less than the cost of the cover provided by traditional breakdown companies, the AA and RAC, even the supermarkets!

European Cover just £13

If you’re planning to drive on the continent at all during the next 12 months, consider SilverKNIGHT RESCUE Advance. This extends the above benefits to include the EU and provides 48hr Car Hire. The premium for Advance cover is just £67.50 - what’s an extra £13 compared to the comfort of having cover abroad?

Additional benefits included FREE of charge

On top of the extensive benefits offered by both products, you’ll also be covered for flat batteries, lost or broken keys, accidental damage to tyres and running out of fuel. So this cover really is comprehensive, meaning you’ll be covered for every eventuality.

Simply contact AROC Insurance when your existing breakdown cover is due for renewal or ask us to add it when we quote for your car insurance next.

Call FREE on 0800 008 6687

for low cost breakdown cover.

Home Insurance that’s well-stacked

but not well expensive

What’s included in our well-stacked home insurance:

- ‘New for Old’ replacement of items - to replace your damaged or stolen old items with brand new ones.

- Accidental damage to contents - to cover the accidental breakage of TVs, DVD players, video players, hi-fi equipment, home computers (not laptops), radios.

- Property Owner’s Liability - to cover any amount that you become legally liable to pay as the property owner in compensation for death, bodily injury or illness to any person or damage to their property.

- Service pipes and cables - to repair accidental damage to cables, drain inspection covers, underground drains, pipes or tanks providing services to or from your home.

- Loss of keys/Lock Replacement - to provide emergency assistance and pay towards the cost of replacing your locks if your keys are stolen.

- Accidental damage to buildings - cover for glass in conservatories and windows and doors, fixed ceramic hobs, bathroom suites.

- Alternative Accommodation - while the home cannot be lived in because of loss or damage covered under the Buildings cover.

- Guaranteed Repairs - a guarantee on the repairs carried out by the insurer’s approved tradesmen.

There’s so much more to the club scheme than just the car insurance. AROC Insurance has everything you could need, from an insurance point of view, all housed under one roof. Which actually brings us on quite nicely to talk about AROC Home Insurance.

More Included as Standard

We believe in giving you all you need to protect yourself. That’s why AROC Home Insurance automatically provides a number of valuable benefits in your cover as standard.

Whether you need a basic ‘Contents Only’ policy because you’re renting or you need comprehensive home buildings and contents cover, AROC Insurance has a benefit-packed solution for you.

And we’re used to dealing with homes of all shapes, sizes and construction so don’t worry if you live in a converted barn or a Kentish oast - let AROC Home Insurance give you a competitive quote.

Affordable Cover

It’s no good giving you a well-stacked policy if it means you have to pay through the nose for it. So, as well as protecting your home and contents, we’ve made sure your pocket is protected by offering competitive premiums.

One particular insurer even gives up to 30% in lifestyle and other discounts and we guarantee to pass on all the savings to you.

In fact, if you already have your car with AROC Insurance we’ll give you an extra £10 OFF our best home insurance deal or £20 OFF if your household has more than one car covered with us.

And, if you’re paying for your current home cover via direct debit, you could switch to AROC Home Insurance whenever you like, for little or no penalty, and start saving money straight away.

Simply contact AROC Insurance for a quote on your home insurance and find out just how affordable our well-stacked cover could be for you.

Call us FREE on 0800 008 6687 and see how much you could SAVE

Money Off Offer Details

Receive £10 OFF our best home insurance quote if you have one ‘live’ car policy with us at time of quoting. Or £20 OFF our best home insurance quote if your household has 2 or more ‘live’ car policies with us at the time of quoting. Not to be used in conjunction with any other offer.

Instant travel quotes online

from AROC Travel Insurance

Great News! We’ve launched a brand new service for AROC members.

You can now benefit from instant, competitive, online travel quotes from AROC Travel Insurance using the "Quote Me Now" button on the right.

Whether you’re after single trip, annual multi-trip or long-stay cover for yourself, your family or a whole group, you can arrange instant cover using our simple travel quote site 24 hours-a-day, 365 days-a-year.

As it’s online, it doesn’t cost the earth either. Chris Knott Travel Insurance offers highly competitive rates for both European and Worldwide cover.

Find out just how affordable our travel cover could be for you by getting an instant quote from AROC Travel Insurance - you can even obtain a ‘Quick Quote’ based on minimal information before proceeding to the full quote.